With a look at what is forecast for the Netherlands, many operators may flock to the region, which is brimming with sports betting revenue potential.

From Alternar's full report, it becomes clear the growth in this market is not only skyrocketing with greater acceptance of iGaming but with greater regulation that allows sportsbook software providers the opportunity to shine. Regulated markets make gaming, betting and gambling more fun and secure, as they add layers of safety for the player and the operator.

With a prohibited unless licensed approach, the Netherlands market is set to burst onto the scene, which can only curate a better iGaming and sports betting market to be a part of.

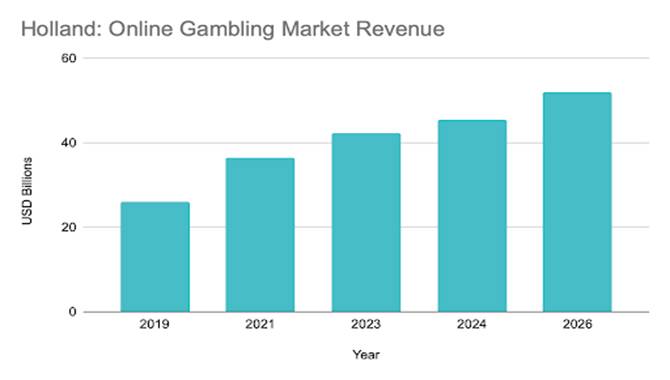

Thanks to greater regulation from 2006 onwards, the 20-year gap has spurred the growth of the market as demonstrated in the graph below.

This graph shows that market revenue has increased from 2019, when it stood at $26.10bn, which climbed to $36.40bn as of 2021 and is predicted to climb higher, with total revenue of $52bn in 2026.

But what else can we find out about the Netherlands sports betting market?

Let’s take a look …

A share of sports betting brilliance

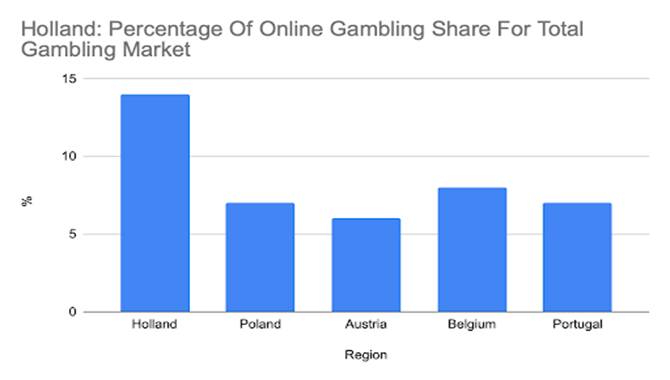

As operators look at the Netherlands for an emerging regulated market, with great potential, it’s important to look at other markets within Europe to evaluate potential in black and white numbers.

This way, it’s easy to see the share of the sports betting pie, or iGaming world, that you could be a part of should you choose to enter the Dutch market.

The graph below shows that Holland (14%) holds one of the highest online gambling shares for its market, in comparison to Poland (7%), Austria (6%), Belgium (8%) and Portugal (7%).

Having a population of sports and sports betting lovers, it’s no wonder players have been betting since 2006. Though, with a lack of regulation in those days, a point of saturation was achieved as the gambling laws dated as far back as the 1960s. With a resounding lack of regulated online gaming during that decade, love for iGaming reached new and unregulated heights that posed a host of problems, though as 2021 approached, a new law was finally passed and iGaming companies could apply for an operating licence.

So, as the Netherlands iGaming market opened up, many software providers and operators realised the potential of the market, not only for revenue but to discover new ways to adapt technologies to best fit the Dutch player, and the regulated market that could see swift changes in its relative infancy.

Altenar’s full market report has a host of information and market know-how that sheds light on the growing potential of the sports betting market in the Netherlands, from revenue growth and overall market share to market revenue by vertical and whether in-play or pre-match betting was preferred by players.

As the market grows, it’s prudent for operators looking to enter the Netherlands market to complete as much research beforehand as they can.