Churchill Downs has posted its Q1 results for 2023, showing $559.5m in total net revenue in the first three months of the year – significantly beating its 2022 total of $364.1m.

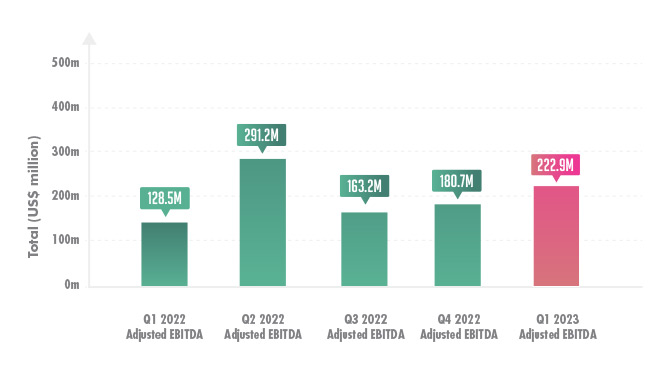

Additionally, the company’s adjusted EBITDA totalled $222.9m, representing a 73% increase annually. Meanwhile, its net income jumped from 2021’s $42.1m to $155.7m for Q1 2023 – marking a 270% rise.

The company’s live and historical racing net revenue for Q1 2023 increased from $87.2m to $215.8m – with its adjusted EBITDA reaching $82.1m for the first quarter, an annual rise of 194%.

As the graph below shows, Churchill Downs’ Q1 EBITDA for 2023 is the second-highest figure it has recorded since the beginning of 2022.

For Churchill Downs, the start of 2023 has marked a strong opening that it will be hoping continues throughout the rest of the year.

For 2022, the company recorded a total of $1.8bn in annual revenue, which marked a record for Churchill Downs for full-year results. Meanwhile, its net income for 2022 of $439.4m also represented a full-year record and was up a significant 76%.

Furthermore, its adjusted EBITDA of $763.6m for 2022 was also a record high and up 22% year-on-year.

2022 also saw Churchill Downs complete a string of acquisitions, including all assets of Peninsula Pacific Entertainment, Chasers Poker Room in Salem, New Hampshire and Ellis Park Racing & Gaming. These acquisitions helped drive the company’s record revenue amounts.