Rush Street Interactive (RSI) has released its Q3 2023 results. The results have shown an overall positive uptick for the company, whose revenue was up 15% from Q3 2022, however the results also revealed that the company is still operating at a net loss.

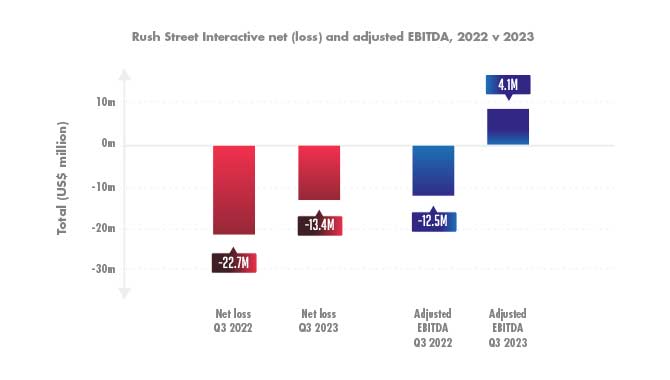

In Q3 2022, RSI was operating at a net loss of $22.7m, with an adjusted EBITDA of a minus $12.5m. In Q3 2023, the net loss reduced to $13.4m, which is an improvement of 41%. In fact, this reduction in net loss resulted in Q3 2023 experiencing a gain in adjusted EBITDA, at $4.1m.

Operating costs were up for RSI, with adjusted operating costs and expenses having increased from $164.5m in Q3 2022, to $174.2m in Q3 2023. This is an increase just shy of 6%; reflecting both an increase in expenditure and the current inflation rate of the dollar.

Other notable metrics from RSI's Q3 report include a decrease in advertising and promotion costs by 23%. Yet in spite of reduced advertising costs, average revenue per monthly active user was up 8% year-over-year, with the average monthly revenue from customers in the US and Canada being $374.

Stock prices for RSI have been on the rise in the past week leading up to Q3 results day, with stock prices sitting at $3.54 as of the time of writing.

On the results, Rush Street Interactive CEO, Richard Schwartz said: “Thanks to our decade-long investment in technology and a customer-centric approach, we've positioned ourselves as a top five online operator in the US. Our third quarter results affirm our ability to deliver on both counts as we continue to acquire, engage and retain customers.”