The American Gaming Association (AGA) has posted May 2023’s commercial gaming revenue figures, showing that total gross gaming revenue (GGR) was up 6% annually.

Total GGR for May across the US stood at $5.49bn. Breaking that figure down, slot GGR for May 2023 totalled $2.98bn – 1% up from last year. However, the big rises came from sports betting and iGaming, with sports betting recording 42% growth, totalling $864.1m – and iGaming taking in $498.4m, representing a 22% annual rise.

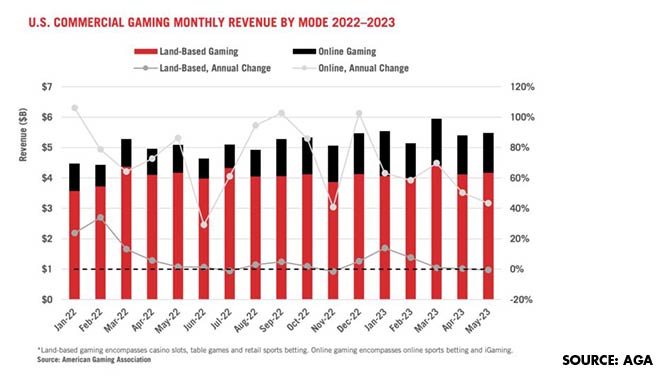

The graph below shows US commercial gaming monthly revenue since January 2022, with online gaming coming to represent a larger total of the US gaming makeup as time goes by.

But it also shows that land-based gaming continues to hover around the 60% mark – meaning that online gaming had a bigger and bigger impact on the market as a whole in the last 18 months.

Furthermore, looking at the numbers from each state, the largest annual change comes from Virginia, which recorded a 133% annual rise – totalling $417.2m.

Massachusetts, the newest state to legalise and launch sports betting – both retail and online – recorded a 77% rise, driven by the aforementioned sports betting legalisation, totalling $160.8m.

On the subject of sports betting, the graph below details the biggest sports betting states by revenue for May 2023. New York’s market is currently dominating the US, standing at $153m – only $46m less than the remaining markets outside of the top 10.

For the year so far, the US’s total GGR is up 12%, totalling $27.6bn. That figure is primarily composed of the $14.8bn made by slot GGR – up 5%; meanwhile, table games were up 2% at $4.11bn.

However, sports betting overtook table games’ value to the US’s total GGR, with sports betting now reaching $4.58bn – a huge 65% rise annually. Finally, iGaming GGR for the year so far reached $2.48bn, a 22% rise.

Meanwhile, for comparison, the National Indian Gaming Commission (NIGC) last week released its Fiscal Year 2022 gross gaming revenue figures for Tribal gaming, totalling $40.9bn.