Paysafe has reported that its revenue increased by 8% to $396.4m, or when judged on a constant currency basis, it grew 5%.

When analysed by specific divisions, the merchant solutions aspect of Paysafe contributed $216.8m to the company’s revenue, an increase of 6% when compared year-on-year.

As for digital wallets, this vertical grew 12% to bring in $182.9m, when compared to the $163m last year.

The intersegment costs grew by 347% for a total of -$3.3m, a portion generated from internal business operations.

Gross profit for this quarter, excluding depreciation and amortisation, was $232.3m, marking an increase of 8%.

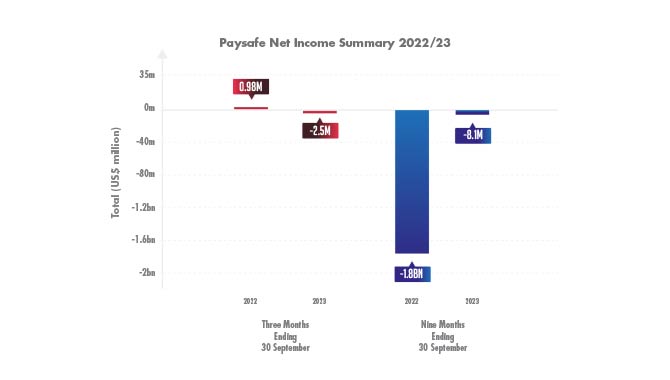

With net income at -$2.5m, this is a difference of 361%.

However, when looking at the figures from a year-to-date perspective, net loss of $8.1m is a significant increase when compared to the $1.8bn net loss (impacted by impairments) recorded last year.

The total payment volume the company handled was $35.1bn, an increase of 8%.

Finally, adjusted EBITDA increased by 22% to $116m.

A chart displaying the net income (loss) at Paysafe, from both the third quarter and the year-to-date for 2022 and 2023 respectively.

Bruce Lowthers, Paysafe CEO, said: “Paysafe has continued to build momentum through the third quarter led by double-digit growth from our e-commerce solutions and classic digital wallets.

“Overall, our third quarter results reflect 8% year-over-year revenue growth, 22% Adjusted EBITDA growth and accelerated leverage reduction.

“These results reaffirm that the execution of our playbook is working and providing the foundation for us to deliver on our strategic initiatives and commitment to achieving our mid-term growth targets.”

As for business highlights, this quarter saw Paysafe partner with Fanatics Betting and Gaming to provide it with a range of payment methods.

Lowthers continued: “I want to thank our extraordinary team for all their hard work as we continue to realign Paysafe in its pursuit of operational excellence.”

In addition, the Board of Directors announced a new scheme this quarter, in the form of a $50m share repurchase programme.

Alex Gersh, Paysafe CFO, said: “This buyback program reinforces the Board’s and management’s confidence in Paysafe.

“With our healthy cash flow generation and consistent progress towards reducing our net leverage ratio over the last several quarters, we believe now is the appropriate time to include share repurchases as part of our capital allocation strategy.

“We continue to expect the majority of our excess cash flow to be committed to de-leveraging, while we also continue to invest in innovation to drive long-term growth.”