Key highlights:

- Total operating revenue rises by 220% annually

- Net loss is at its lowest since the start of the Covid-19 pandemic, sitting at $51.1m

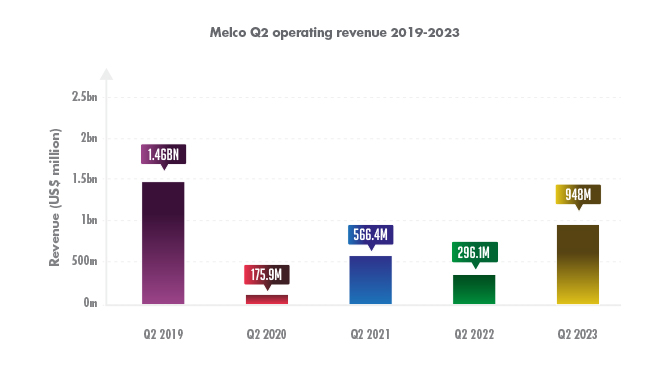

- Though Melco has not yet reported figures at the level of pre-pandemic times, it shows significant signs of recovery

- Melco’s shares rise steadily in the past 12 months

Melco Resorts has published its Q2 report, which shows it has made $948m in total operating revenue – a huge 220% rise year-on-year.

Breaking down the revenue figure for 2023, Melco saw increases across the board, with $768.6m made in its casino division – representing a significant rise against 2022’s $231.9m.

Furthermore, it saw a 200% rise in room revenue, totalling $80m; a further increase in its entertainment, retail and other division, where it made $52.9m vs a $17.5m figure in Q2 2022; while food and beverage revenue rose by 133%, totalling $46.5m.

The graph below shows Melco’s total Q2 operating revenue from 2019-2023, which clearly shows the tough Covid years Melco has endured since the beginning of the pandemic – although Q2 2023’s total shows signs of complete recovery coming in the near future.

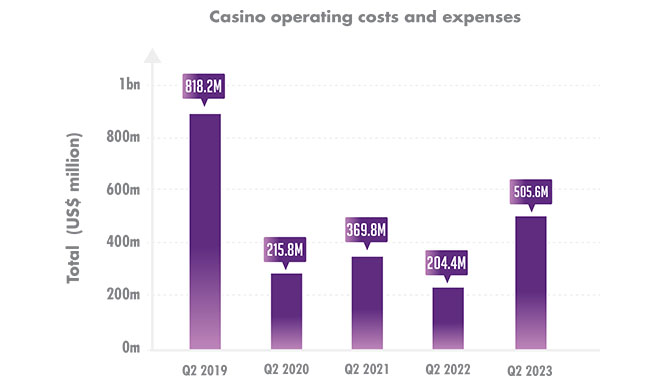

Meanwhile, Melco’s total operating costs and expenses stood at $883.7m for Q2 2023, up from the $505.3m reported in Q2 2022.

Looking at the breakdown in operating costs and expenses for Q2 2023, Melco’s biggest expenditure is seen in its casino division, which, at $505.6m, totals more in Q2 2023 than the company’s whole operating cost and expenses total in Q2 2022.

Below is a graph that shows what Melco has spent on its casino division since 2019 – which highlights Melco’s incremental recovery in Q2 2023, in a similar trend seen in its operating revenue.

Looking at net loss/profit for Q2 2023, Melco reported a $51.1m loss – a significant improvement on Q2 2022’s $294.0m loss.

Since Q2 2019, when the company made a $99.3m profit, Melco has seen consistent losses in its subsequent Q2 reports – with Q2 2020 posting a $426.8m loss, Q2 2021 seeing a $220.1m loss and Q2 2022 showing the aforementioned $294.0m loss.

Its relatively moderate loss in Q2 2023 again shows the trend that Melco may only be 12 months away from complete recovery in Q2 2024 – as well as becoming profitable again. Time will tell.

Looking at net loss/profit for Q2 2023, Melco reported a $51.1m loss – a significant improvement on Q2 2022’s $294.0m loss

Additionally, Melco’s H1 figures show a recovering business, with $1.7bn made in total operating revenue over the first six months of 2023 – a significant 121% jump on H1 2022’s $771m.

This is the largest H1 total in this calendar decade, with only 2019’s $2.8bn higher. It also represents only the second time it has seen a figure of over a billion dollars since the dawn of 2020, with its 2021 figure standing at $1.09bn.

Melco’s share price has only increased in the last 12 months, priced at $5.08 on August 2, 2022. However, it is (at the time of writing) now priced at $13.17, slightly down from its year high of $14.39 on 21 April 2023.