Key highlights:

- MGM’s total consolidated Q2 net revenue at five-year high, totalling $3.9bn

- However, its regional operations' net revenue fell 4% year-on-year

- MGM China’s net revenue of $741m is higher than 2019’s $706m – and 418% up year-on-year

- But MGM’s consolidated net income plummeted by 85%

MGM Resorts International has posted its Q2 2023 report, showing a consolidated net revenue total of $3.9bn.

Its overall revenue for Q2 2023 is up on Q2 2019’s $3.22bn figure, meaning Q2 2022’s net revenue of $3.26bn was the year that MGM recovered from the pandemic, with Q2 2023 now proving that MGM has stabilised its income.

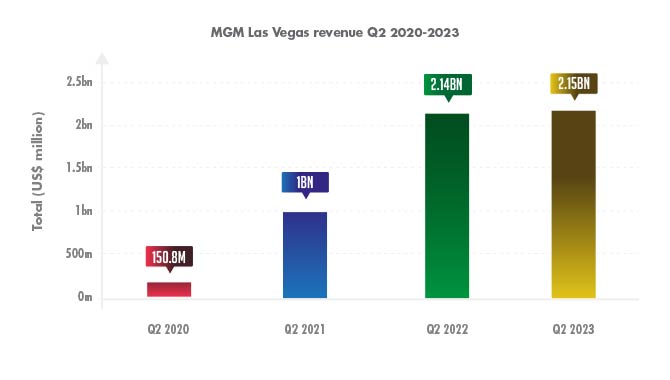

MGM’s revenue is comprised of three divisions, Las Vegas, US regional operations and MGM China. Breaking down its $3.9bn figure, the Las Vegas Strip remains by far the largest market for MGM, recording $2.15bn in revenue – slightly up from the $2.14bn it made in Q2 2022.

The graph below shows MGM’s Las Vegas revenue from Q2 2020 to Q2 2023; what can be seen is a stabilisation of revenue in the US gambling hub over the course of Q2 2022 and Q2 2023, following the effects of the pandemic in 2020.

Outside of Las Vegas, MGM’s Q2 2023 regional revenue recorded a sum of $926m, representing a 4% drop on Q2 2022’s $960m figure; however, this was still up on Q2 2021’s $856m and far ahead of Q2 2020’s $89.2m (which saw closures during the pandemic). The slight drop is unlikely to phase MGM too much, as its overall consolidated net revenue recorded its highest figure in the last five years.

Meanwhile, MGM China’s revenue totalled $741m – a surging 418% rise on Q2 2022’s $143m. This is primarily down to the easing of lockdown rules in Macau and the end of China’s zero-Covid policy. Furthermore, in Q2 2021, MGM China recorded net revenue of $310.6m – itself an 838% increase on Q2 2020’s $33.1m.

"Earlier this year, MGM also was given the green light to build Japan’s very first casino resort in Osaka"

However, the biggest plus for MGM China is that Q2 2023’s net revenue of $741m was actually a 5% increase on 2019, meaning it has shown a complete recovery following the pandemic struggles it (and every other casino in Macau) endured.

Earlier this year, MGM also was given the green light to build Japan’s very first casino resort in Osaka, which represents a major new platform for the casino operator in Asia – though this will not be open until 2030, at the earliest.

MGM's adjusted EBITDAR totalled $1.14bn, up from the $920m it recorded in Q2 2022. This continues MGM's EBITDAR growth, with 2021 posting $617m and 2020 coming in with a huge EBITDAR loss of $492m.

Again, MGM's Q2 2022 and Q2 2023 EBITDAR highlights its post-pandemic recovery, with 2019's EBITDAR totalling $764m.

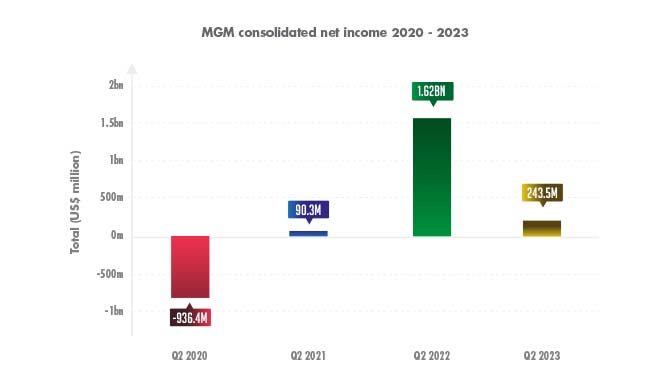

Meanwhile, MGM’s consolidated net income fell significantly against Q2 2022’s $1.62bn – representing an 85% drop. However, MGM’s consolidated net income has been very uneven since 2020, which the graph below showcases.

MGM’s share price has risen steadily since 3 January, when it sat at $34.14, recording a high of $50.77 on July 27. In the past five days, it has fallen slightly to $49.34 (at the time of writing), though this remains part of an overall upward trajectory for MGM.

Finally, for H1 2023, MGM has made $7.82bn vs H1 2022’s $6.12bn – a 28% rise annually.

Breaking that figure down, all of MGM’s three divisions were up on the previous year, with Las Vegas up from $3.80bn to $4.32bn – MGM’s regional operations slightly rising from H1 2022’s $1.85bn to $1.87bn – and MGM China vastly increasing to $1.36bn from H1 2022’s $411.4m