Key highlights

- Statutory net loss of AU$2.44bn due to fines issued throughout the year

- Statutory gross revenue of AU$1.87bn, up 22% year-on-year

- Total liabilities decreased by 23% to AU$1.49bn

- EBITDA rose by 34% to AU$317m

The Star Entertainment Group (The Star) has posted its yearly financial results ending 30 June 2023, reporting a significant statutory net loss of AU$2.44bn ($1.57bn), down 1,103% compared to last year’s statutory net loss of AU$199m.

Despite the drastic net loss that was reported, The Star brought in gross revenue of AU$1.87bn, which is up 22% when compared to last year's $1.53bn.

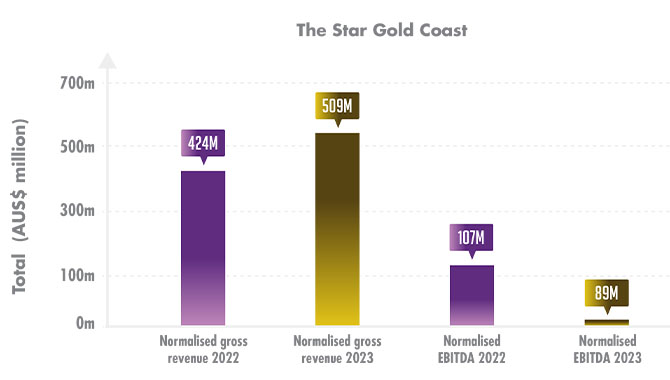

EBITDA decreased by 17% year-on-year at The Star Gold Coast.

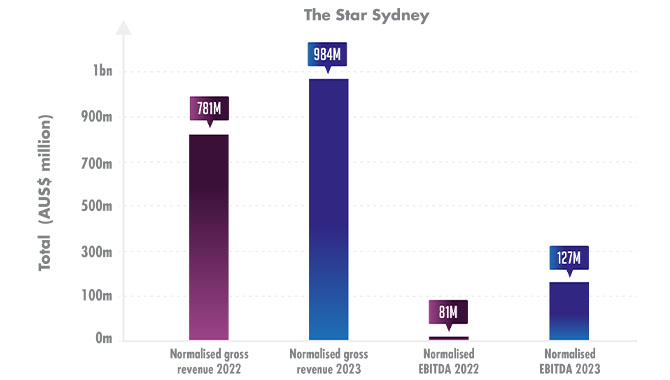

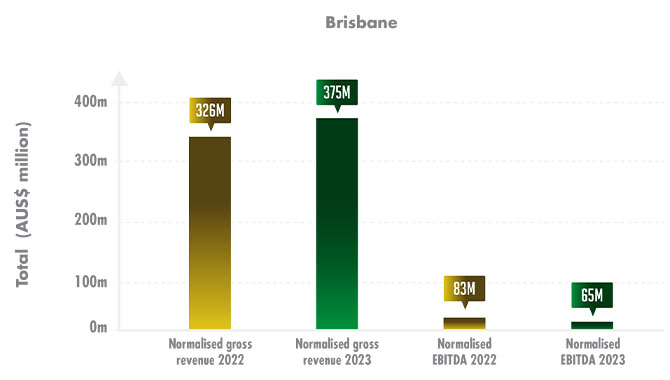

Year-on-year, The Star Sydney saw a 26% increase in normalised gross revenue to AU$984m, with a 57% increase in EBITDA to AU$127m. The Star Gold Coast’s normalised gross revenue increased 20% to AU$509m, with a 20% increase in EBITDA to AU$107m. Brisbane made a 15% increase in normalised gross revenue to AU$375m; meanwhile its EBITDA also rose by 29% to AU$83m.

The Star Sydney is the highest revenue earner out of the three casinos.

EBITDA also went up 34% year-on-year to AU$317m. Meanwhile, total liabilities have decreased 23% from AU$1.84bn to AU$1.49bn.

The report stated that significant items of the loss predominantly include: non-cash impairment of the Sydney, Gold Coast and Treasury Brisbane goodwill and property assets (AU$2.17bn), regulatory and legal costs (AU$595m), debt restructuring costs (AU$54m) and redundancy costs (AU$16m).

The Star's Brisbane casino made the least normalised gross revenue overall.

The loss was certainly associated with the fines given to the company throughout the year.

To prevent any further action and/or costs from regulators, the company has approved an in-principle agreement with the NSW Government to amend casino duty rates, completed AU$800m equity raising with ‘AU$779m net proceeds applied to repay and/or cancel debt facilities.’

The company is also going to implement a AU$100m cost-out program, reducing the headcount by 500 with ‘no impact on risk and compliance roles.’ It has also reached an agreement to sell the Sheraton Grand Mirage Resort Gold Coast for AU$192m.

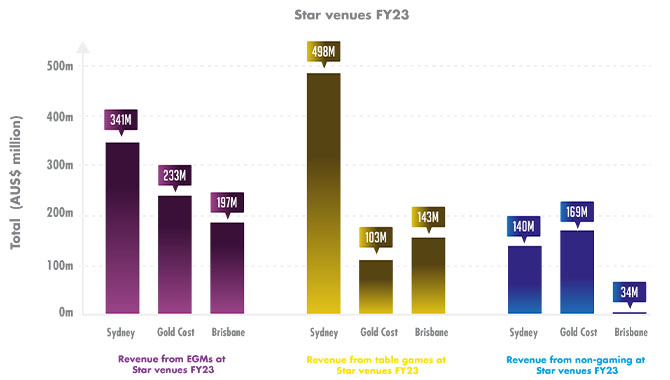

Regarding revenue made from EGMs, table games and non-gaming, The Star Sydney appeared to be ahead on table games and EGMs, however The Star Gold Coast generated the most revenue from non-gaming at Star venues.

This table reflects the amount earned in its casinos across different verticals.

The remediation measures to be taken are: working towards returning to suitability, repair and strengthening The Star’s relationships with relevant regulators and other stakeholders in NSW and Queensland, as well as a continued focus on safer gambling and AML / financial crime uplift along with culture transformation.

Since June 2022, the company has replaced its entire Board, refreshed its leadership team, its risk and compliance team has increased from 53 full-time members to 83, the safer gambling team has increased from 18 to 55 full-time employees and the AML team has expanded from 26 to 99 full-time employees.