Key highlights

- Sands’ Q3 net revenue hits $2.8bn, up 180% year-on-year

- Meanwhile, Q3 adjusted EBITDA records a 486% jump

- Marina Bay Sands records over $1.01bn alone, making up 35% of Sands’ overall net revenue

- Sands’ current market capitalisation sits at $35.67bn, with a share price of $46.64

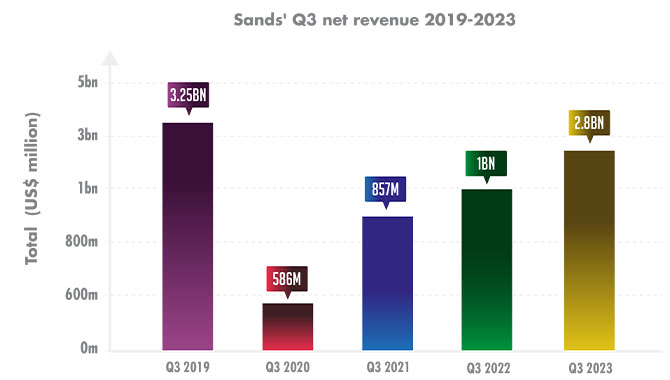

In its Q3 report for 2023, Las Vegas Sands’ net revenue has seen a 180% increase year-on-year, totalling $2.8bn. This increase has been put down, in no small part, to the re-opening of Macau – following the Chinese Government’s abandonment of its zero-Covid policy after rare mass protests in the country.

Looking at Q3 2023’s revenue compared to Sands’ Q3 revenue reports dating back to 2019, what can be seen is a recovery of the gambling giant’s income.

The graph below shows that Q3 2023 has closed in on 2019’s $3.25bn, with Q3 2024 a potential date marking parity with the pre-pandemic era.

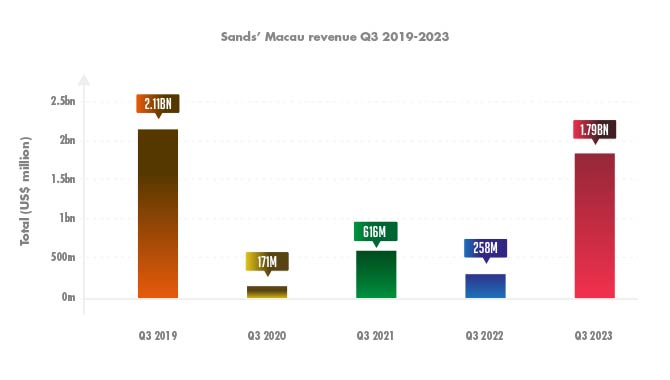

In the graph below, Sands’ individual casino net revenue in Macau can be seen to have risen significantly year-on-year, with the Venetian making over seven times what it made in Q3 2023 – totalling $723m against $104m for Q3 2022.

Meanwhile, the Londoner Macao made almost 10 times more in Q3 2023. The casino recorded $518m for the period, while in Q3 2022 it made $57m.

The graph underneath shows the performance of Sands in Macau compared to that of its prior Q3 results going back to 2019. Sands’ net revenue in the Chinese province has, much like its overall net revenue, almost recovered fully from the Covid-19 pandemic.

Moving to Singapore now, where Sands’ mighty Marina Bay casino resort stands. As the biggest casino in all of Asia and one of the biggest in the world, the resort is responsible for keeping Sands’ operations and net revenue as strong as it has been through the pandemic era.

However, since then it has also pushed on to surpass the net revenue it made in 2019. In Q3 2023, Marina Bay Sands made $1.01bn in net revenue – making up a whopping 35% of Sands’ entire net revenue as a company.

Compared to Q3 2022, the Singapore-based resort has increased its net revenue from $756m to the aforementioned $1.01bn.

Much of this is down to Macau’s recent struggles and the VIP market that left the Chinese hub behind to gamble in Singapore instead – seeing Marina Bay Sands’ results highlights that this trend shows no signs of stopping anytime soon.

"In Singapore, Marina Bay Sands again delivered outstanding levels of financial and operating performance. Our new suite product and elevated service offerings position us to deliver future growth as airlift capacity continues to improve and the recovery in travel and tourism spending from China and the wider region continues" – Robert G. Goldstein, Chairman and CEO of Las Vegas Sands

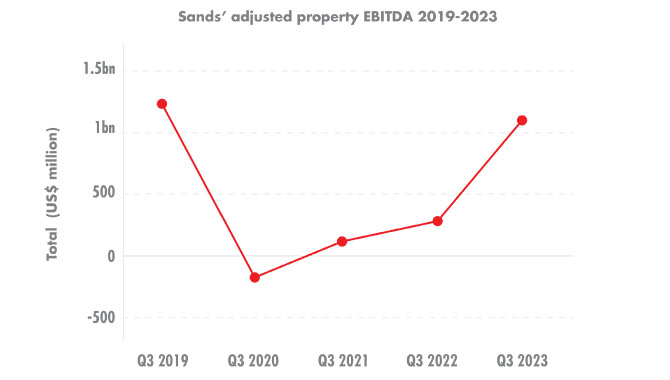

Moving on to Sands’ adjusted property EBITDA, which totalled $1.12bn in Q3 2023, this figure is a massive 486% increase from last year's $191m.

Again, the reason for the increase is due to the reopening of Macau, with the Venetian seeing its adjusted EBITDA hit $290m, up from the negative $37m in Q3 2022.

The graph below plots the course of Sands’ adjusted property EBITDA since 2019, showing that Sands’ adjusted property EBITDA has now all but achieved parity with the pre-pandemic era.

Now to Sands’ net income from continuing operations, where the company revealed it hit a profit of $449m for Q3 2023 – drastically up from the negative $380m it made in Q3 2022.

In Q3 2021, the company also recorded a significant loss of $594m, as well as an even bigger loss of $731m in 2020. This is in contrast to the $669m in profit it made in 2019, making Q3 2023 the first time Sands’ has seen a profit in Q3 since before the pandemic.

For the year so far, Sands is vastly up on the first nine months of 2022, recording a net revenue of $7.46bn in 2023 against $2.99bn in 2022.

This is also reflected in its adjusted property EBITDA, with the first nine months of the year seeing Sands report a sum of $2.89bn – 466% up on 2022’s $510m.

Additionally, its profit for the period stands at $962m vs the $1.27bn loss it made in the same period last year.

"In Macau, we were pleased to see the recovery in both gaming and non-gaming segments progress during the quarter" – Robert G. Goldstein, Chairman and CEO of Las Vegas Sands

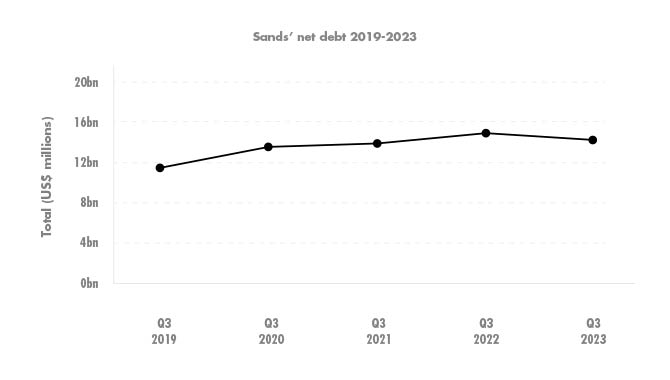

Sands’ net debt up until September 30, 2023, stands at $14.17bn – which increased as a result of the severe impact of the pandemic, but this figure is down from the $15.27bn it recorded in Q3 2022.

The graph shows the level of debt that Sands has seen since 2019, showing the impact of the pandemic across four years.

At the time of writing, Las Vegas Sands’ share price stands at $46.64. This total is relatively low compared to the year it has had so far, with its high coming on May 1, when it hit $64.86 – while it started the year on January 3 at a cost of $49.33.

The low came on October 5, when it sank to $44.10, however, it has bounced since, likely as a result of its Q3 report.

Finally, Sands’ market capitalisation currently stands at $35.67bn, again, at the time of reporting.