Key highlights

- Evolution’s revenue is up 20% annually to €452.6m

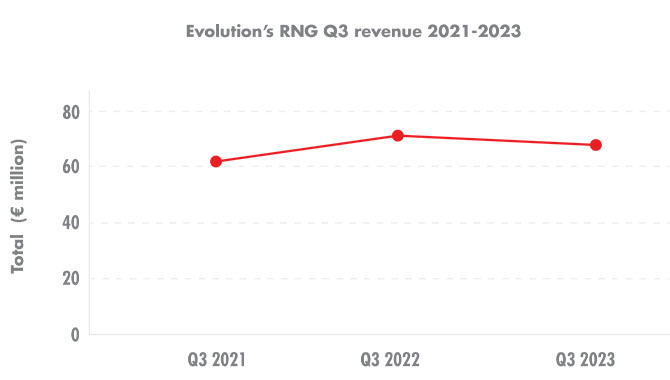

- Meanwhile, its RNG division fell by 2% year-on-year

- The company also recorded a profit for the period of €272.8m

- It boasts a market capitalisation of SEK 213.02bn

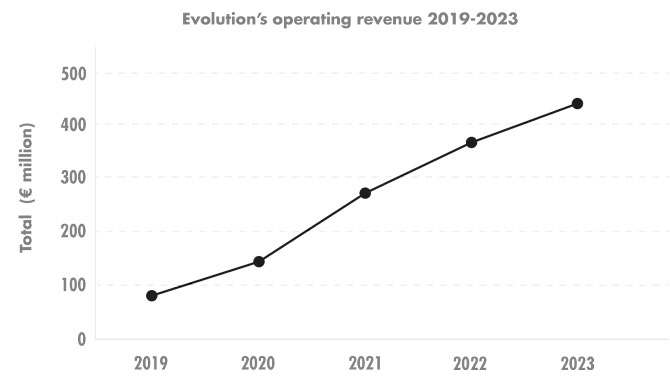

Starting with Evolution’s Q3 operating revenue, the company saw a 20% increase year-on-year during the quarter – totalling €452.6m ($477.6m) vs Q3 2022’s €378.5m.

Breaking this down, Evolution made €385.8m from its live casino division, a decent rise on last year’s €310.4m – meanwhile, its random number generator (RNG) arm saw revenue of €66.8m, which is down by €1.3m annually and represents its lowest sum for a year.

The graph below shows the company’s RNG performance across the last three quarters, which shows a general rise for the division.

Despite the 2% fall in its RNG figures, Evolution CEO Martin Carlesund said it has made progress, stating: “RNG revenues amounted to €66.8m and declined 2% compared to the corresponding quarter last year. Despite the step back in year-on-year growth, it was a quarter when we made progress in our RNG operations.”

However, Carlesund also highlighted the performance of its live casino division and how it can go further, adding: “Our live casino revenue grew to €385.8m for the quarter and we see a higher demand for our product than what we currently can deliver. That is a measure of the phenomenal traction our games have.

“However, it also means we are not expanding our studios at the right pace. We have faced delays and, in some cases, not executed fully in several of our planned studio projects for this year. But, even more importantly, we need to increase the pace of recruitment both in existing studios as well as to support new studios.”

Looking at Evolution’s overall operating revenue against its previous years, the graph below shows the rate at which the company grew – with Q3 2022 to Q3 2023 representing the lowest percentage rise in that period. Of course, this is down to the levelling off of the group’s staggering performance as it settles further into its markets.

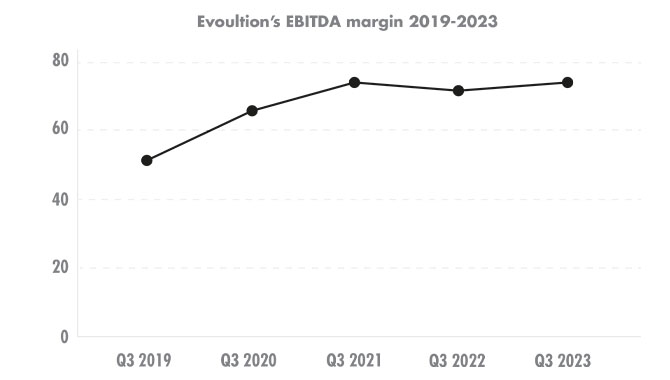

Moving on to Evolution’s EBITDA, the company saw an EBITDA margin of 70% – up 1% from Q3 2022’s EBITDA margin of 69%. Overall, the EBITDA figure for Q3 2023 was reported as €318.6m – up 22% annually, which is almost exactly level with the company’s revenue.

Comparing the company’s EBITDA sum since Q3 2019, the company has reported a significant rise every quarter. For Q3 2019 to Q3 2020, Evolution recorded a rise of 87%, totalling €90.7m. A year later in Q3 2021, that sum rose to €193m (a 113% increase), while Q3 2022 saw that rise slow to 35%, with €261m reported.

The graph below shows Evolution’s EBITDA margin over the past five quarters, which highlights the company’s steady EBITDA margin growth and levelling off in the past three quarters.

Now to Evolution’s profit for the period, annually this saw a 23% rise, totalling €272.8m – this figure is the company’s highest recorded profit during its Q3 season.

When looking at this sum’s rise against the figures it reported in Q3 since 2019, the 23% of Q3 2023 – like the rest of its financials in this quarter – also represents a slowing down of Evolution’s surge.

Its largest year-on-year increase came between Q3 2019 and Q3 2020 when its profit for the period went up by 100%. This was closely followed by Q3 2021, when it totalled 98%.

Evolution’s nine-month performance has also seen a steady increase annually, with its operating revenue for the first nine months of the year hitting €1.32bn – representing a 26% rise against the first nine months of 2022.

This trend is also seen in its EBITDA, which recorded a sum of €930.5m – 28% against the same period for last year. Meanwhile, its profit for the period saw a 27% increase, totalling €788m.

Evolution’s overall report shows a company that has settled more and more into its place in the market. It is no longer recording increases of 100% year-on-year, but the size of the figures it is reporting makes it an industry juggernaut – one that is dominating.

In his comments, Carlesund also spoke of the company’s performance in North America and how he expects to see further growth as iGaming expands.

“North America is a region that we expect to develop over many years as more US states regulate. The online casino market is still in an early stage of development. We continue to see growth for our live product quarter to quarter in the existing states, while we in the past quarter take a step back in our RNG revenue compared to the second quarter”

Finally, Evolution’s share price has fallen in the past 48 hours (at the time of writing) in anticipation of the Q3 report to a yearly low of SEK 949.70 ($85) – down from the SEK 1,053.60 it recorded on Wednesday. Its high of SEK 1,449.0 came on June 2.

Currently, Evolution’s market capitalisation sits at SEK 213.02bn.