IGT generated revenue of $1.06bn, consistent with the prior-year and the previous quarters; showing no growth in revenue for the past few financial periods.

Of that revenue, global lottery made up $601m, down 4% year-over-year; global gaming brought in $409m, up 8%; and PlayDigital made up the remaining $55m of revenue, representing a minor 1% increase.

IGT explained why there was a dip in PlayDigital by stating: “Growth in iCasino was offset by the impact of exiting certain legacy iSoftBet jurisdictions and unusually high sports betting hold levels in the prior year.”

Total operating income increased 13% to $239m. When broken down, global lottery brought in $206m, down 2% year-on-year; global gaming increased 42% to $93m; and PlayDigital increased 32% to $16m.

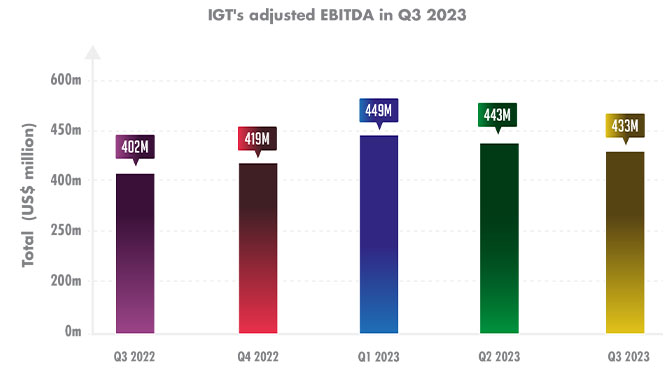

Adjusted EBITDA rose 8%, from the same period in 2022, to $433m.

The graph shows how IGT's EBITDA has fluctuated across the quarters; falling slightly in Q3 2023 from Q2 2023.

Earnings per share dropped by 65% from $1.30 to $0.46; meanwhile, adjusted earnings per share increased 21% to $0.52. The company stated in its report that the drop in earnings per share reflected non-operating income related to ‘the gain on sale of Italy commercial services and non-operating expenses related to the DDI/Benson matter the previous year.’

Net debt at the end of the period inclined 3% year-on-year to $5.3m from $5.1m. Meanwhile, net income dropped to $123m from $294m in the prior-year period.

Within this period, IGT secured a seven-year extension on its lottery contract with the California Lottery through to October 2033. Additionally, IGT also secured 10-year contract extensions as retail and iLottery systems partner to the Kentucky Lottery Corporation through July 2036.

In its fourth quarterly report, IGT expects to hit a revenue mark of $1.1bn with an increase in revenue within its global lottery, PlayDigital and global gaming sides of the business.

Vince Sadusky, CEO of IGT, commented: "The strength of our leadership positions across Global Lottery, Global Gaming, and PlayDigital is evident in our third quarter and year-to-date results. Excellent momentum in key performance indicators is driving revenue growth and even stronger profit expansion.

“With a compelling pipeline of innovative products and solutions showcased at recent trade shows, I am confident we can achieve our near and medium-term goals as we focus on unlocking the intrinsic value of IGT's market-leading assets."

Max Chiara, CFO of IGT, stated: "We are pleased with the financial results we delivered in the third quarter, including top-line growth, margin expansion, and strong cash flow generation.

“Our financial position is solid with net debt leverage at a historical low point and already comfortably within our long-term target range, which coupled with no meaningful near-term debt maturities and access to significant liquidity, greatly enhances our balance sheet and creates additional financial flexibility."