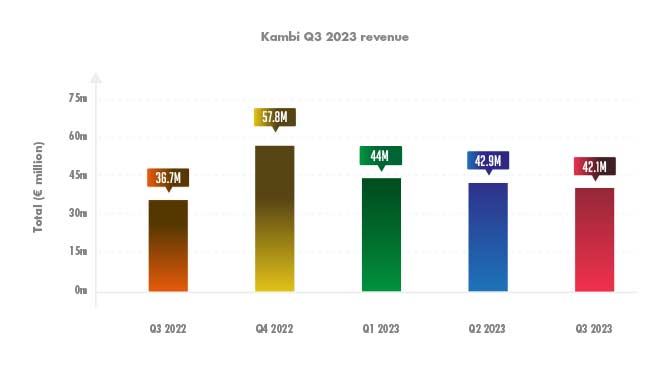

Kambi's Q3 revenue amounted to €42.1m ($44.4m), up 15% compared to Q3 2022.

Revenue growth of 15% was ‘boosted by certain non-recurring fees in relation to Penn and Shape Games’.

EBITDA for the third quarter came in at €13.9m, up 30% from the same period in 2022. Operating profit also rose by 19% to €4.6m; and profit after tax also rose 37% to €3.5m.

Meanwhile, both earnings per share and fully diluted earnings per share increased by 39%: to €0.117 and €0.116 respectively.

Kambi completed 24 partner launches during Q3, including eight in the US for new partner Bally’s, in the states of: Arizona, Colorado, Mississippi, New Jersey, Ohio and Virginia.

The graph shows that Kambi's revenue has fluctuated over the quarters, but it still remainsup year-on-year. Q4 2022 was boosted by the FIFA World Cup.

The graph shows that Kambi's revenue has fluctuated over the quarters, but it still remainsup year-on-year. Q4 2022 was boosted by the FIFA World Cup.

In September, Kambi also powered Churchill Downs' launch across seven on-property locations on day one of regulated sports betting in Kentucky. Elsewhere in the US, Kambi completed an online launch and two retail launches with BetParx in Maryland.

As a result of the above, during Q3 2023, the Americas contributed 50% (53%), Europe 47% (43%) and Rest of the World 3% (4%) of the total operator gross gaming revenue.

During Q3, Kambi signed contract extensions with ATG and Rank Group; as well as having entered into a long-term sportsbook platform and front-end agreement with the Swedish operator Svenska Spel.

Additionally, Kambi completed two partner signings in Q3, including an agreement with Eyas Gaming to power the operator’s Lance! Betting brand in Brazil. Kambi also partnered with Prairie Band Casino & Resort in a multi-year deal to power the launch of the first Tribal sportsbook in Kansas.

What’s next for Kambi? The 2027 financial targets for the company are: to get revenue of two to three times of FY2022 levels (i.e. approximately €330-€500m) and for EBIT to be in excess of €150m.

Kambi plans to reach these targets by retaining key partners, rolling out AI-powered pricing, sign tier-one operators and launch in a major regulated Asian market.

Kristian Nylén, Kambi CEO and Co-Founder commented: “The landmark signings of Svenska Spel and LiveScore Group are Kambi’s most significant partner agreements with existing sports betting revenue in our history and represent a major step forward towards our long-term strategic goals.”