Sphere Entertainment, a land-based casino and live entertainment company, has published its Q1 2024 report for the three months ending 30 September 2023, typically published as a Q3 2023 report.

The company holds two major brands; Sphere and Madison Square Garden (MSG) Networks, and as such the majority of the report will be divided between the two.

Combined Sphere Entertainment statistics:

- Revenue decreased 4% to $118m

- Total operating income decreased 37% to -$69.8m

- Total adjusted operating loss decreased 88% to -$57.9m

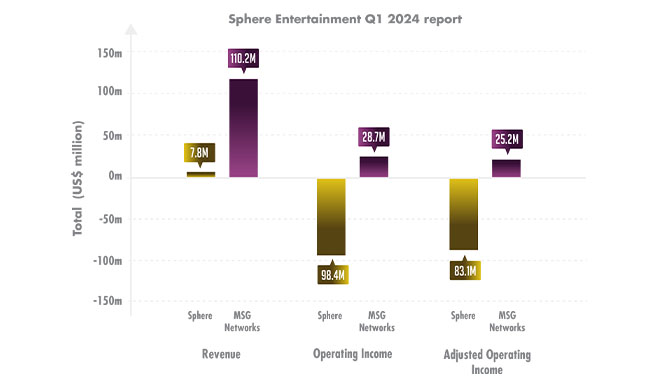

The above chart represents the revenue, operating income and adjusted operating income from both brands managed by Sphere Entertainment.

Following these results, Sphere CFO Gautam Ranji resigned from the company on 3 November.

Sphere

The revenue for the Sphere increased from $0.7m in 2022 up to $7.8m, an increase that can likely be attributed to the opening of Sphere in Las Vegas.

Operating income was reported to be -$98.4m, a change of -25% when compared year-on-year, but to be expected from a venue that only opened on 29 September 2023.

Adjusted income for the Sphere was -$83.1m, a fall of 30%.

However, the property has had a busy opening schedule all the same; 11 additional U2 shows had to be added to the calendar due to initial shows selling out, the launch of the Sphere experience, its first-ever brand campaign on the Exosphere with YouTube's NFL Sunday Ticket and future Formula 1 announcements.

James Dolan, Executive Chairman and CEO, said: "Sphere's opening in Las Vegas in September represented a significant milestone, generating worldwide attention and marking the beginning of a new chapter for our Company.

“We are building positive momentum across Sphere and remain confident that we are well positioned to drive long-term value for shareholders."

MSG Networks

The revenue for MSG Networks, which operates as a sports and entertainment network, was down 10% to $110.2m.

Operating income saw a mild 2% increase to $28.7m, but an overall adjusted operating income of $25.2m, a decrease of 24% when compared year-on-year.