Operator Rivalry has announced its Q3 2023 results, posting improvements in all segments year-on-year.

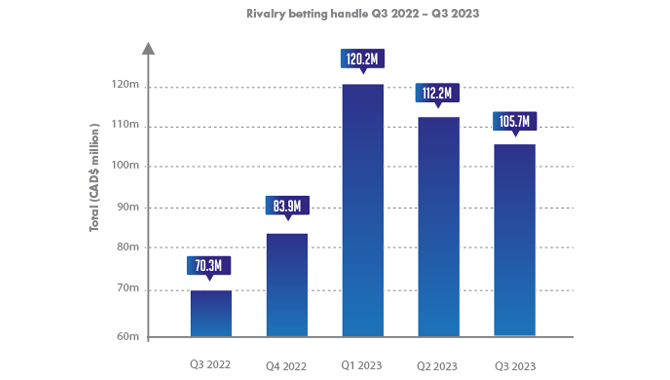

The company’s betting handle saw a 50% increase year-on-year in Q3 2023, reaching at CA$105.7m (US$77.8m), though as the graph shows, there has been a quarter-by-quarter decrease since the start of this year.

Nearly half of Rivalry’s betting handle for the third quarter 2023 came from the casino segment (CA$50.4m), with the company citing recent casino product launches, a new original game and the release of Casino.exe on its iOS mobile app in Ontario as key reasons behind the continued growth in this segment.

Revenue was CA$8.7m in the third quarter of 2023, representing a year-on-year increase of 22%, while gross profit was CA$4m in the third quarter of 2023, showing an increase of 90% year-on-year.

There was a slight decline in operating expenses and net loss saw a decrease of 6% year-on-year, being valued at CA$5.6m for Q3 2023.

During the quarter, Rivalry launched a same-game parlay product for esports to help with an improved sportsbook product mix and to help towards an enhanced margin profile.

As of 30 September 2023, the company had no debt and had CA$7.4m of cash.

Co-Founder and CEO of Rivalry, Steven Salz, said: “We are proud to have delivered a record third quarter while exercising discipline on costs amidst a challenging capital markets environment for growth companies.

“Now, with our recently announced capital infusion, we will be able to go back on the offensive, while still maintaining our path to profitability.”

In the middle of this month, Rivalry announced a CA$14m investment, with the capital being used to ‘accelerate growth across marketing, product development and geographic expansion.’