Key highlights:

- Net debt hits four-year high of £2.59bn

- Entain’s current market capitalisation hits £8.58bn, after a rocky year so far for its share price

- The company’s underlying EBITDA is at a high of £499.4m

- Meanwhile, BetMGM sees an annual growth of 65%

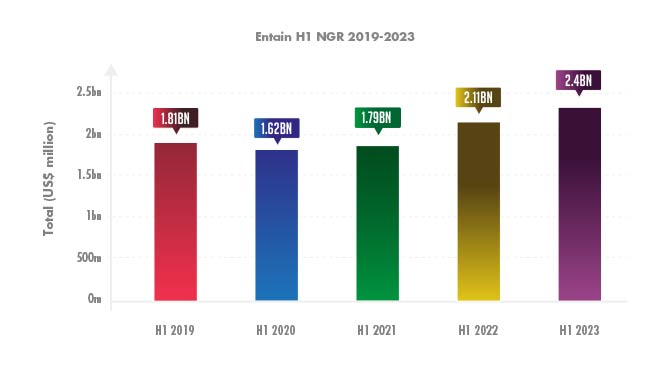

Entain has posted its H1 report for 2023, revealing net gaming revenue (NGR) of £2.4bn ($3.06bn).

The sum represents a 14% increase on H1 2022, where it posted £2.1bn – while its general revenue saw a similar increase, making £2.38bn against H1 2022’s £2.1bn.

Breaking down its NGR, Entain’s online business increased by 15% annually, while retail saw a 12% rise year-on-year – however, its 50% stake in BetMGM gave Entain its biggest percentage increase, reporting 65% growth year-on-year. In total, BetMGM saw an H1 NGR of $944m.

The graph below shows Entain’s NGR since 2019, showing a steady rise since 2020 – before which it saw an 11% drop from 2019 to 2020.

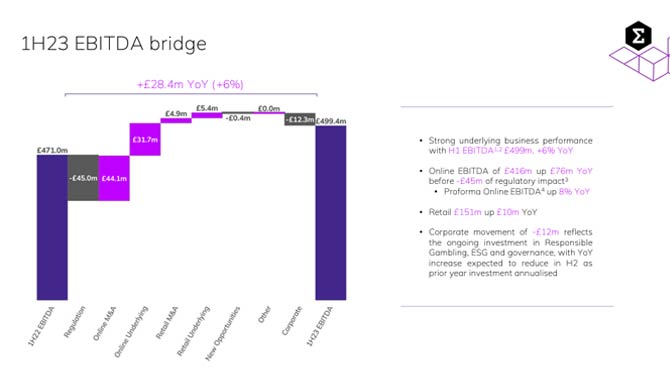

Meanwhile, Entain’s underlying EBITDA increased by 6% from H1 2022, with a figure of £499.4m reported in H1 2023.

Since 2021, Entain’s underlying EBITDA has risen, albeit incrementally – with H1 2021 posting £401.1m and H1 2022 recording £471m.

The graph below (provided by Entain) shows its ‘EBITDA bridge,’ in which it details its £28.4m annual H1 growth.

Source: Entain

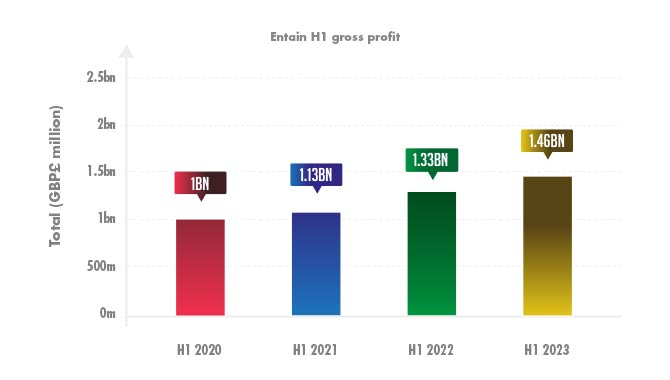

Meanwhile, looking at Entain’s gross profit, which totalled £1.46bn in H1 2023, its 10% increase on H1 2022’s £1.33bn represents smooth growth for the company annually.

Over the course of the last four years, as the graph below shows, Entain’s gross profit has – in a similar fashion to its NGR and underlying EBITDA – risen steadily.

However, despite its gross profit rising, overall for H1 2023, Entain has made a loss of £502.5m, compared to a profit of £28.1m.

The heavy loss is primarily down to Entain putting £585m aside for a settlement in regards to the Crown Prosecution Service’s ongoing investigation into the company’s Turkish operations – which it sold in 2017 under the name of GVC Holdings.

Otherwise, the figures suggest that Entain would have made a profit of circa £82.5m.

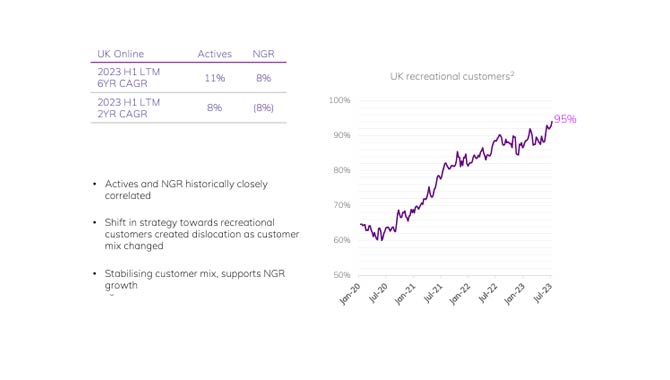

Entain’s own data also reveals that its UK recreational customer base has been growing significantly in the past four years – rising to 95% by July 2023, which can be seen in the graph below.

Source: Entain

Additionally, Entain’s net debt now sits at £2.59bn – higher than it was a year ago when it recorded a £2.21bn figure. Over the course of the previous four years, Entain’s net debt has only fallen below the two-billion threshold once, which came in H1 2021 when it totalled £1.95bn.

Since the start of 2023, Entain’s share price has seen significant rises and falls – with reports of a takeover bid from MGM causing spikes. On January 3, Entain recorded a price of £13.50, with a yearly high of £15.87 coming on February 3 – meanwhile, its yearly low came on March 28, when it fell to £11.71.

its market cap stands at £8.58bn – a price that’s still significantly lower than the $20bn offer tabled by DraftKings for the company in 2021

As of the time of writing, Entain’s price stands at £13.33, while its market capitalisation stands at £8.58bn – a price that’s still significantly lower than the $20bn offer tabled by DraftKings for the company in 2021.